Dive Brief:

- At Home closed on a $200 million private placement, the retailer announced on Friday. A private placement allows a company to offer shares to a group of pre-selected investors.

- The company also completed some refinancing transactions. As a result of the recent financial moves, the company said it expects to exchange about $447 million of its existing unsecured notes for exchange notes in aggregate principal amount of $412 million.

- Overall, the financial transactions will allow At Home to strengthen its balance sheet and take advantage of opportunities in the home sector as Tuesday Morning and Bed Bath & Beyond exit.

Dive Insight:

Tuesday Morning and Bed Bath & Beyond’s failure could be At Home’s gain. The Texas-based retailer said the complete shutdown of two rivals positions At Home “to take advantage of opportunities created by recent competitive exits in the sector.”

At the time of their respective Chapter 11 filings, Tuesday Morning and Bed Bath & Beyond had 487 stores and 360 stores, respectively. That means more than 800 brick-and-mortar locations selling home goods and decor will be wiped off the map as they go out of business. After opening a store in April in Fort Wayne, Indiana, At Home’s total store count sits at 262.

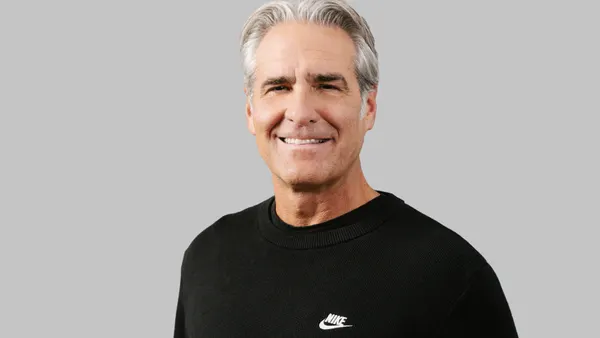

Lee Bird, At Home’s CEO, said the financial moves provide the company with incremental capital to support growth objectives and its strategic plan. “With these transactions, we are able to further invest in our business and strengthen our position as the leading destination for home decor,” Bird said in a statement. “And with significant runway to add stores, we believe we are well positioned to continue our long track record of double-digit growth in the coming years.”

Private equity firm Hellman & Friedman acquired the company in 2021 for $2.8 billion. The company no longer is required to publish full financial statements. But in 2020, the retailer said it had $1.7 billion in revenue and $77 million in net income. The company says it employs more than 7,000 people.

Last year, S&P Global Ratings lowered At Home Group’s corporate credit rating to B- from B. S&P cited weakening sales and cash flow, along with higher freight costs and falling consumer demand. Several retail sectors, including home, surged when the pandemic hit, but subsequently slumped as people shifted their spending to other areas when work-from-home requirements eased.

Last fall, At Home launched a mobile app and expanded same-day delivery. In March, At Home implemented price drops on items like rugs, furniture and decor. The company raised prices in 2021 due to supply chain and freight cost increases.