It’s hard to not bring up self-checkout when discussing the convenience store industry’s evolving use of technology.

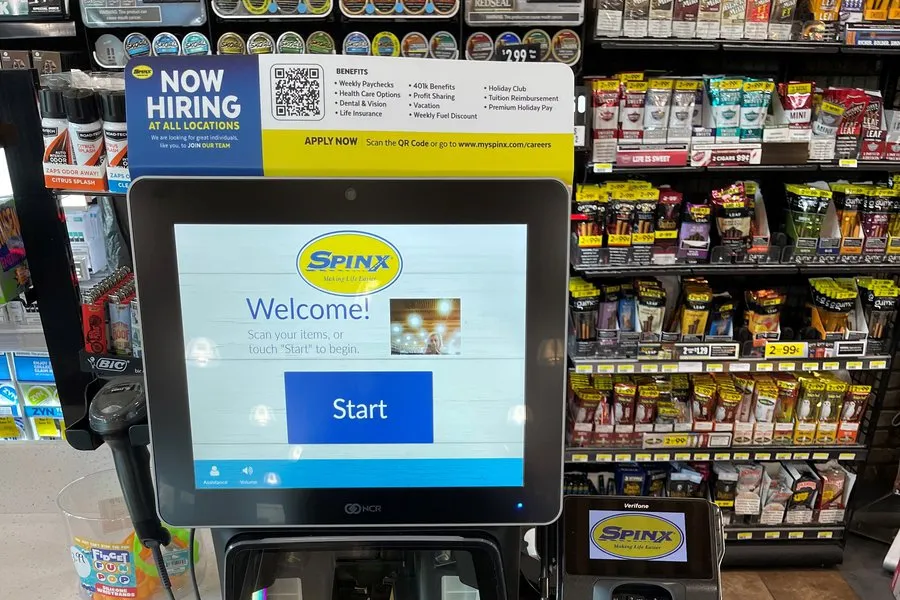

Over the past few years, major c-store players like Circle K, Wawa and Sheetz have taken on autonomous checkout in various forms like standard kiosks or mobile scan-and-go. Smaller chains such as Spinx and Texas Born are tapping into the technology as well.

Self-checkout can speed up a customer’s store visit, and it appeals to those who don’t want to interact with a cashier.

“Having a self-checkout option gives people an option who are just looking to grab something and get out quickly or not have to speak with somebody as part of their transaction,” Linnea Geiss, chief operating officer of retail loyalty and technology company PDI Technologies, said in a recent webinar breaking down c-store trends for 2023.

While retailers can use self-checkout to eliminate their cashier roles altogether, Geiss said the retailers she’s seen deploy self-checkout have used it to augment the interplay between cashiers and customers — not to replace that dynamic entirely.

This could, in turn, give retailers a bit more freedom in terms of how they staff their stores, she said.

“Maybe you don’t need to have your cashier shifts staffed to peak transition times because you can use your self-checkout to augment it,” she said.

This appears to have been Spinx’s mindset when the retailer took on the technology last year. When Spinx launched its self-checkout kiosks, it moved those teammates who usually run the registers to instead focus on store cleanliness.

“We’ve heard from some peers in the industry that customers can get upset and interpret the implementation of this technology as reducing jobs, but in our case, nothing could be further from the truth,” Spinx President Stan Storti said at the time.

Costs and drawbacks

Although the different self-checkout technologies vary in cost, a new self-checkout kiosk averages around $30,000, while a four-lane kiosk setup averages around $125,000, according to pricing information site KompareIt.

Geiss said if a retailer has the capital and the transaction flow to support getting a self-checkout system, then it could be worth the investment.

On the other hand, standard self-checkout kiosks aren’t the most reliable systems and can often frustrate those operating them.

About 67% of consumers said they’ve had a self-checkout machine fail on them while using it, according to a 2021 survey from experience management platform Raydiant. Additionally, self-checkout systems can lead to increased theft at stores, whether intentionally or by customers accidentally making a mistake with how they scan their items.

Moreover, some people may not know how to use self-checkout systems altogether, creating even more frustration for customers and staff.

“I think we can all relate to the experience of being behind somebody [in line] who doesn’t know how to use that technology,” Geiss said.

Follow the customer

So is self-checkout worth the investment? That depends — and it essentially comes down to who the customer is and what they want.

“If you’re in an area where the volume warrants it, I think it’s worth trying,” Geiss said.

PDI CEO Jimmy Frangis said in the webinar that leveraging traditional self-checkout is a “great tool under the right circumstances.”

However, he noted that while standard and mobile self-checkout platforms “will be important moving forward,” knowing how consumers want to transact and interact with c-store retailers — and meeting those needs — is the main priority.

“I think we should be prepared to give consumers those choices,” he said.