Dive Brief:

- Poshmark's third-quarter revenue grew 16% to $79.7 million, a figure that fell short of analyst estimates.

- The resale specialist's estimates for Q4 also fell short of expectations, sending the company's stock down more than 18% after the announcement, according to Seeking Alpha.

- Some analysts, including Roxanne Meyer at MKM Partners, lowered their price targets for Poshmark stock. Meyer cited "what has consistently been limited upside to fundamentals since going public earlier this year."

Dive Insight:

Poshmark CEO Manish Chandra described in a statement a "solid" Q3 that brought what would be in many realms of retail stellar growth. Gross merchandise value was up 18% to $442.5 million while active buyers on Poshmark's platform rose 17% year over year to 7.3 million on trailing 12-month basis.

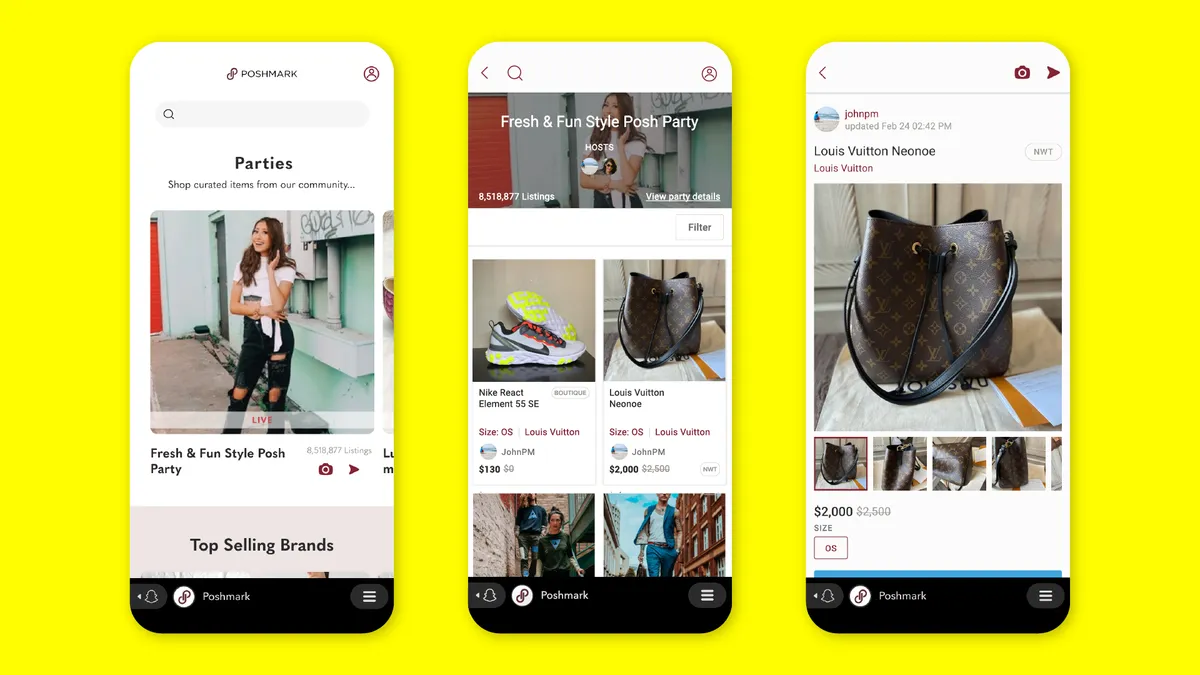

The company also had some notable highlights, including the launch of "Brand Closets," which opens up Poshmark's platform and tools to big brands. The company also acquired machine learning firm Suede One, entered India (its first Asian market) and expanded a partnership with buy now, pay later specialist Affirm.

Analysts have come to expect higher growth from both e-commerce and resale specialists. As MKM's Meyer pointed out, Poshmark in Q4 of this year has a specific competitive advantage over retailers.

"While we had viewed 4Q as a unique opportunity for [Poshmark] to capitalize on the supply chain constraints faced by the majority of the retail industry, 4Q guidance doesn't assume a bullish outcome, and is below our prior view of sales and EBITDA," Meyer said in an emailed research note.

Retailers of all stripes are facing shipping delays, unholy freight costs and in some cases product shortages. By specializing in domestically sourced used goods, Poshmark and its peers are largely sheltered from such global supply chain choke points.

The company cited as a headwind to sales Apple's recent changes to privacy that crack down on tracking and targeted advertising, which has had the effect of raising marketing costs.

On a call with analysts, Chandra said that the changes had increased Poshmark's marketing costs, particularly around new users, according to a Seeking Alpha transcript. Meyer said that the Apple changes "seem to be impacting [Poshmark] more than peers, with EBITDA expectations falling short due to meaningfully higher marketing to support (what is now lowered topline) growth."

As Meyer noted, the privacy changes also dragged on Poshmark's active customer growth, which in turn hurt sales and EBITDA.