Dive Brief:

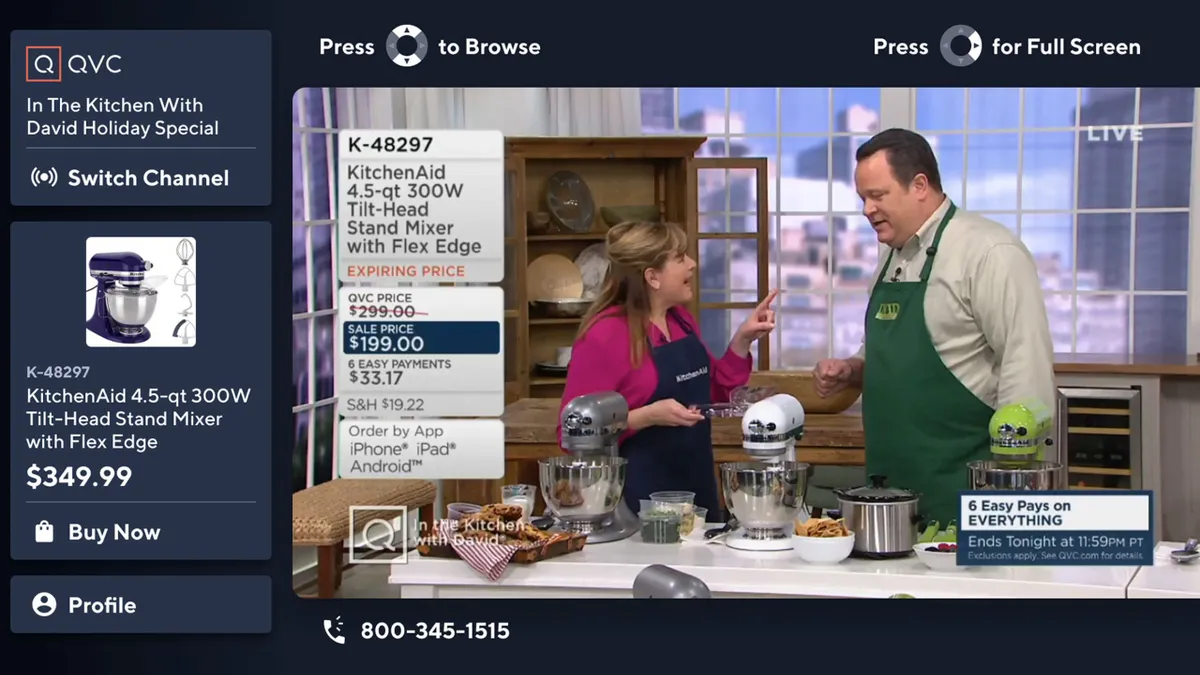

- Qurate Retail Group laid off 400 people, or about 12% of its corporate headcount this week, mostly impacting its QVC and HSN brands. The move will generate $60 million in savings but won’t “have a meaningful impact on quarterly results until the second quarter,” CEO David Rawlinson said on a Wednesday earnings call.

- The company reported that its fourth quarter revenue fell 13% to $3.5 billion, while e-commerce revenue fell 14% to $2.3 billion — 64% of total revenue for the quarter. Qurate also said revenue for its Zulily e-commerce brand decreased 28% for the quarter and 38% for the year.

- For the full year, Qurate’s total revenue was down 14% to $12.1 billion from $14 billion year over year. E-commerce revenue fell 14% to $7.6 billion. Overall, the company swung to a total retail operating loss of $2.04 billion, from $1.1 billion in operating income in 2021.

Dive Insight:

Qurate Executive Chairman Greg Maffei described 2022 as “a horrible year.” But Maffei added, “we think we’ve bought ourselves time to implement this turnaround story.”

Rawlinson also acknowledged that “2022 was a challenging year” for the company.

“While we recognize headcount reductions are hard decisions, we know rebalancing our workforce is right for our business going forward,” Rawlinson said, according to an earnings call transcript.

The layoffs affect a number of roles within the company’s retail group team. People who held roles with the QVC U.S., HSN and corporate shared services teams lost their jobs, according to a statement. Qurate said the job cuts are part of the company’s turnaround plan, which is focused on reducing costs, optimizing the brand portfolio and growing faster in streaming.

Those who were let go will receive severance pay and outplacement services. They’ll also receive extended access to the employee assistance program, and continued benefits coverage through COBRA for an extended period at the team member rate, the company said this week.

Qurate states that its most recent slate of business and operational challenges date back to December 2021, when a fire broke out at the company’s second-largest fulfillment center in Rocky Mount, North Carolina. A 21-year-old employee died and 75% of the 1.5 million square foot facility was destroyed. Qurate decided not to reopen the fulfillment center, resulting in the permanent loss of about 2,000 jobs.

The fire resulted in $21 million in costs in Q4 of 2021, and in the most recent quarter, Qurate says it incurred an additional $29 million of restructuring and fire-related costs. Federal investigators said in December they were unable to determine the fire’s cause. Qurate also received $280 million in insurance proceeds as a result of the fire, the company said Wednesday.

“Throughout 2022, we pulled back on receipts due to a lack of space in our fulfillment centers following the fire at Rocky Mount,” Rawlinson said. “This receipt management impacted our ability to offer customers fresh merchandise. In Q4, it affected several categories, but particularly on home, accessories, and apparel at QVC; and apparel, accessories and jewelry at HSN; and on our top customers who index to these categories.”

Headquartered in the Philadelphia region, the company also has seen several recent executive leadership changes.

Rawlinson is less than two years into the role, having served as CEO since October 2021. Last summer, the company named Jim Hathaway interim chief financial officer. Hathaway replaced CFO Jeff Davis, who left to work as CFO of Dollar Tree. This week, the company named Bill Wafford as its permanent CFO, starting March 20. Hathaway will step into a new role as CFO of QVC U.S.

Last fall, Qurate created a new role, chief transformation officer, and appointed William Hunter to the position. Hunter was formerly the company’s senior vice president of business transformation and shared services. The company said at that time that Hunter’s focus is to execute on Qurate’s turnaround strategy, dubbed Project Athens. Also last fall, the company named Scott Barnhart chief operating officer.

Hathaway said the company’s debt level is manageable with $1.1 billion drawn on its revolving lines of credit. “We took significant action throughout 2022 to create liquidity and position ourselves to execute on our strategic priorities,” Hathaway said Wednesday. As of Dec. 31, Qurate retail had total cash of $1.3 billion.