Dive Brief:

-

About 26% of mobile smartphone users worldwide have downloaded shopping apps, with downloads of such apps increasing by 76% from 2015 to 2016, according to data from mobile technology company StartApp that was shared exclusively with Retail Dive.

-

The data also showed that India is home to 25% of shopping app downloads worldwide, while Asia could be responsible for as much as 40%. North America is the second-largest region for shopping app downloads with 17%, while the U.S. alone is responsible for about 13% of all shopping app downloads globally.

-

StartApp's information was gathered from 350,000 different apps of over 1 billion mobile users. The apps studied use StartApp's marketing and analytics technology in their code.

Dive Insight:

In looking at these numbers, there is clearly still plenty of room for growth, especially when compared to the more popular photo, entertainment and music apps, which have all been downloaded more than shopping apps. For example, gaming apps have been downloaded by 78% of global users, while communications-related apps came in at 77% and social network apps at 73%.

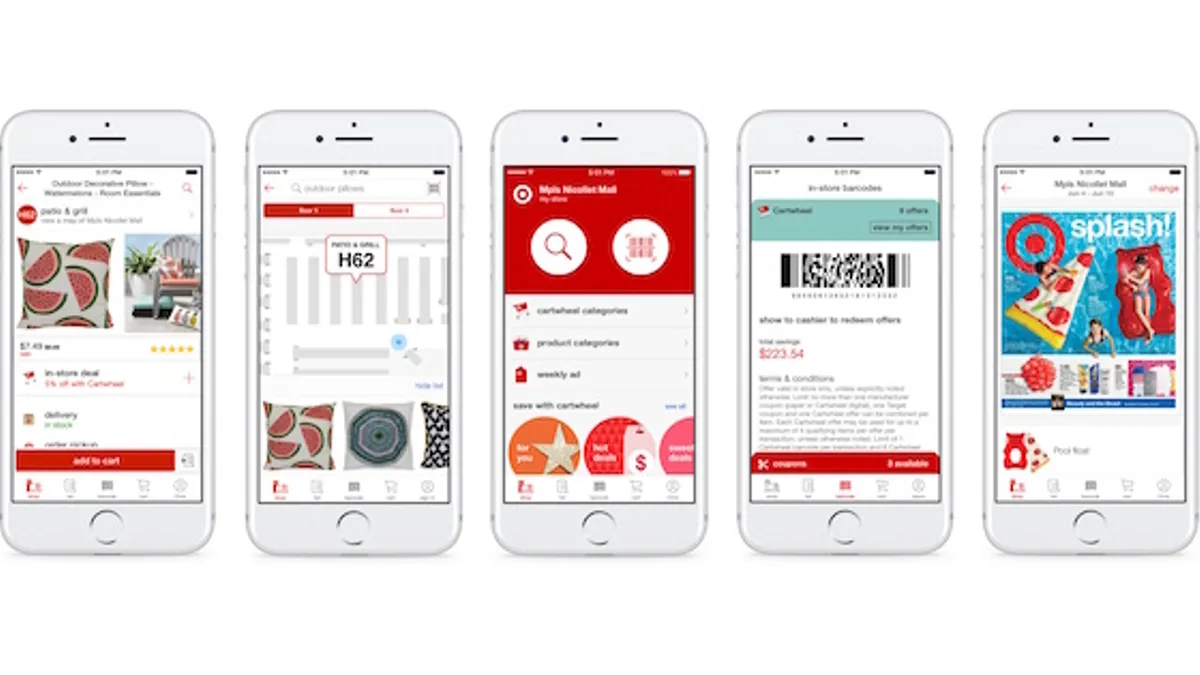

Despite their lower download percentage, shopping app downloads are growing faster right now than any other sector except gaming, Yinon Horwitz, director of business development for StartApp, told Retail Dive. "Spending is growing on mobile shopping apps and they have other purposes, like helping retailers to connect with shoppers while they are in-store," he said. "So shopping apps are proving very useful."

Horwitz also gave Retail Dive a breakdown of the different types of shopping apps that make up that 26% figure — and the overall picture is fairly fragmented. For example, buying-and-selling apps (like eBay, Alibaba, etc.) represented an astonishing 18% of that 26% global figure, while coupon and discount-related shopping apps represented 9% and fashion-related apps accounted for just 6%. (StartApp said it couldn’t provide percentages for specific apps, brands or retailers.)

StartApp's data suggests that retailers that haven’t invested a great deal in shopping apps can still jump into the game — and probably should. As they do, they might want to take a long look at the Indian market, and see if it makes sense for them to be there, judging from the high percentage of shopping app downloads happening in India.

That high level of mobile activity comes while Flipkart and Amazon have both been making e-commerce and mobile investments in the Indian market, which an A.T. Kearney study recently named the top country for retail investment.