With the Holidays fast approaching, Ibotta surveyed 2,500 consumers and 400 industry experts to help inform strategies to best break through this Holiday season.

Looking for new customers? 42% of shoppers said that when they tried a brand for the first time, it was the result of a digital offer.

Looking to drive trial? 76% of shoppers report sticking to brands they like; 75% are willing to try a new brand if it’s offered at a lower price (assuming the quality is equal).

An overwhelming majority of shoppers say that it’s important for them to save money right now (87%), according to first-party Ibotta research. Unsurprisingly, the top reported reasons all tie back to rising grocery costs and inflation, with "offsetting price increases" (40%), "feeling financially secure" (38%), and simply "getting by" (38%) being the top reasons.

Given that 59% of marketers say "consumer consideration" is the most important funnel priority, it’s crucial for them to strategize how to best engage their customers (and potential customers) with digital offers that have a high impact on consumer behavior. This is especially true as they shift their dollars into digital, with 43% spending more on digital promotions today vs. three years ago.

Looking ahead to the Holiday season, brands can drive consideration and trial at scale via the Ibotta Performance Network (IPN). While winning loyalty and capturing share of wallet are tougher than ever before — brands are turning to Ibotta and the IPN to align seasonal programs with key objectives and drive growth in Q4 2023.

Sentiments across US shopper landscape

Consumer economic pressures

As previously noted, 87% of shoppers surveyed feel that it’s important to save money.

This is at a time when 76% of shoppers claim the economy has a “direct impact” on their grocery spending habits. How do shoppers feel about the economy?

58% describe the “overall economic conditions in the US” as less than satisfactory (“poor” or “fair”) with only 9% stating “excellent.”

Advertiser economic pressures

Compared to shoppers, advertisers seem slightly less pessimistic. 47% sense that the overall economic conditions are “weak” or “fair.” While a larger portion of advertisers stated “average” (32% compared to 22%, respectively), a mere 3% of advertisers stated “excellent.”

In terms of budget allocation, the #1 most important funnel priority among marketers is increasing consumer consideration (59%), as previously noted.

More than any other marketing tactic, paper coupons are more likely to be viewed as less of a priority compared to 3 years ago (27%). In contrast, 89% believe digital promotions can help increase sales (compared to 69% for paper).

Key areas to activate

Digital dominates

Given that 68% of shoppers use digital devices to aid their in-store shopping journey, it should come as no surprise that 70% prefer digital offers to paper. 62% of shoppers have either downloaded a cash back app or store app for savings offers or looked for digital coupons. Only 28% have clipped paper coupons.

Furthermore, digital offers across the Ibotta Performance Network (IPN) average a 24% redemption rate versus 0.28% for free-standing inserts (FSIs), as noted in The End of the FSI?

Among those who used a digital device to aid their shopping journey, a significant portion (44% before the trip, 35% during, and 38% at checkout) were specifically seeking digital offers.

A significant opportunity for brands lies in the fact that digital marketing strategies can have a higher impact on consumer behavior.

Driving new-to-brand purchases

Brands leveraging digital offers are well positioned to deliver price relief that shoppers have come to rely on. 42% of the time a shopper tried a brand for the first time, it happened as a result of a digital offer.

While 76% of shoppers report sticking to brands they like, 75% are willing to try a new brand if it's offered at a lower price (assuming the quality is equal).

Whether a brand is looking to drive trial or gain new purchasers for an existing product, these findings reveal strong opportunities for realized gains via digital promotional offers.

Driving loyalty and advocacy

62% of shoppers said they were more likely to continue buying from a brand if they received some sort of reward for being a customer. This sentiment was even more prevalent among digital users, with 68% saying that digital offers made them “feel valued as a customer.” This is a crucial insight, given that nearly half (49%) of shoppers make brand choices based on the extent to which they feel appreciated as customers.

These digital offers don’t just incentivize loyalty, they also fuel advocacy. A remarkable 59% of shoppers in the consumer sentiment survey are likely to recommend a brand to others due to the impact of a digital offer.

Putting it all into action

The tremendous influence of digital offers on consumer behavior is undeniable: driving new-to-brand purchases, fostering brand loyalty, prompting customer advocacy. Digital offers give brands a high-impact avenue to connect with today’s shopper.

The Ibotta Performance Network is your one-stop-shop for first-party data analytics measuring both incentivized and organic purchases across the US grocery industry, in addition to exclusive reach to over 120M American shoppers across a wide ecosystem of properties including retailers like Walmart, Dollar General, and more.

Advertisers on the IPN average:

- 7X return on ad spend (ROAS)

- 50% lift in incremental units sold

- 42% of conversions new-to-brand

- 70% shorter purchase cycle

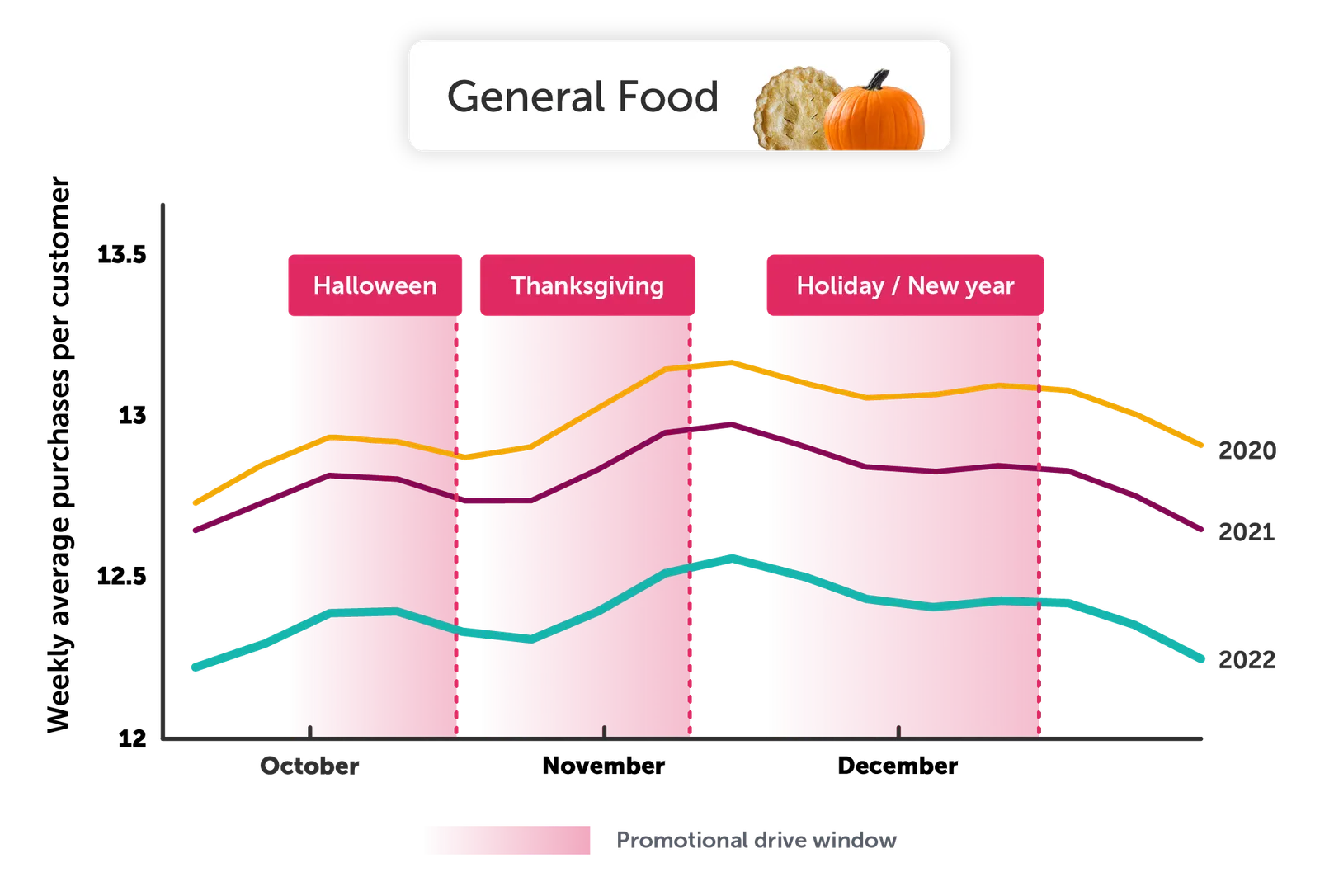

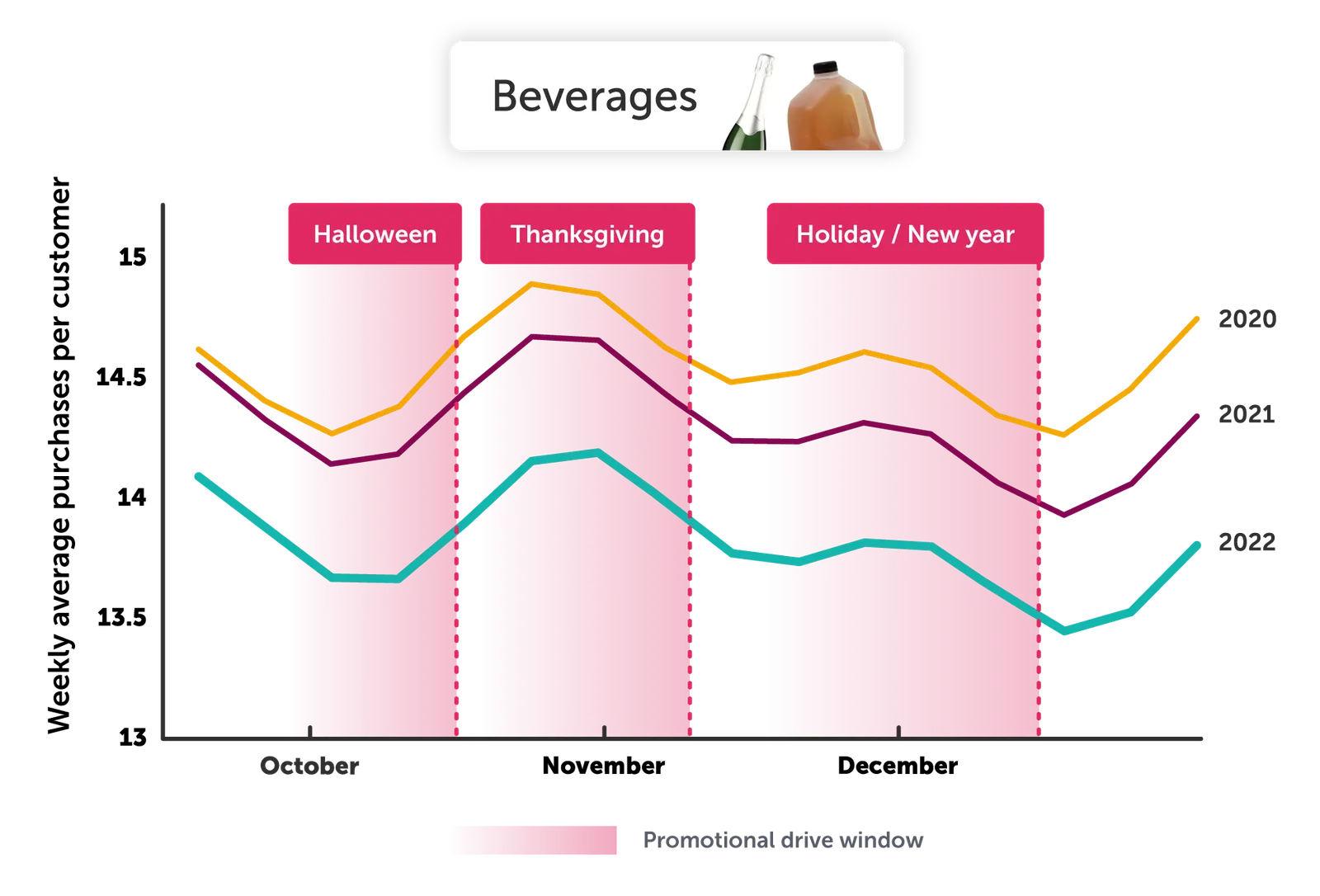

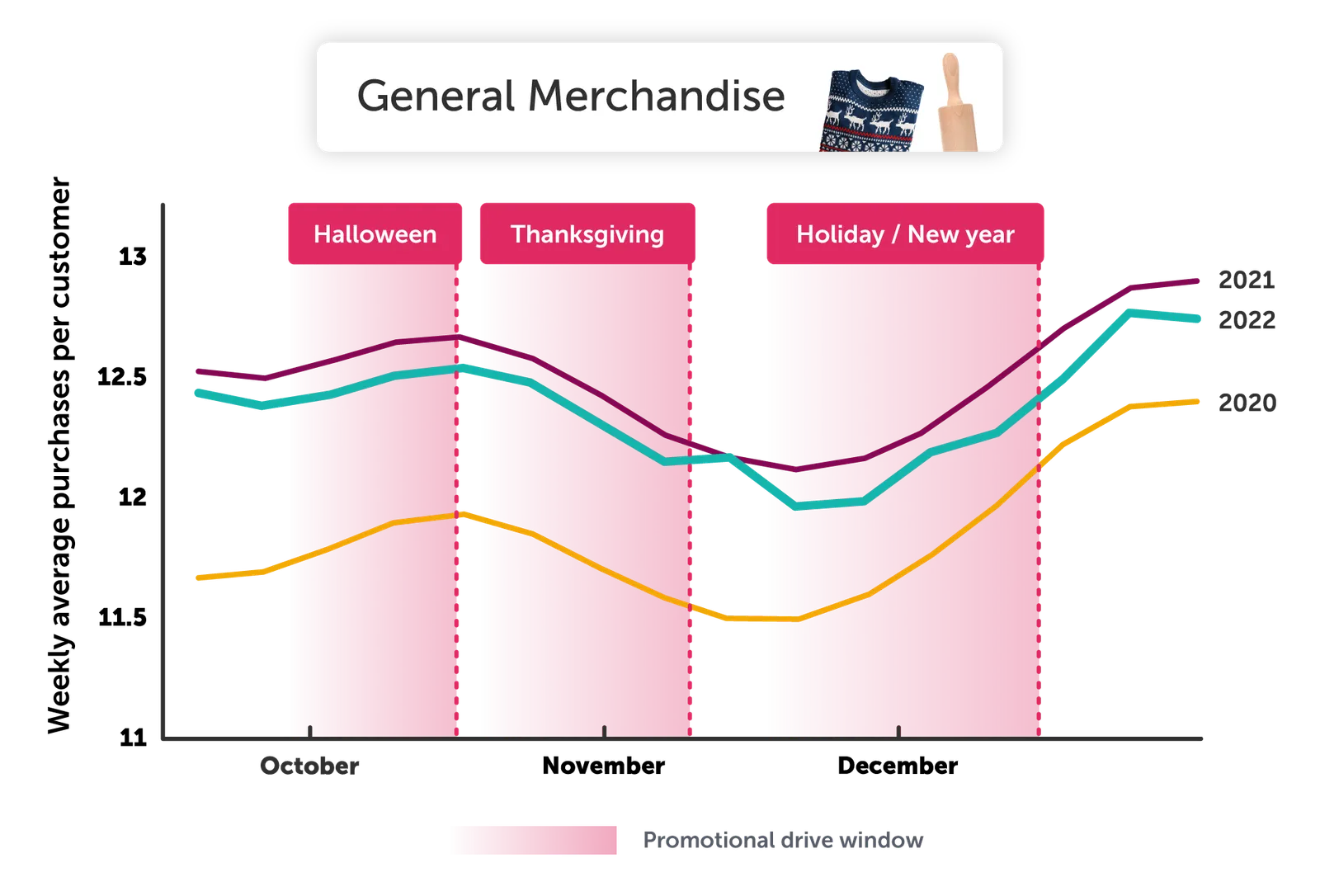

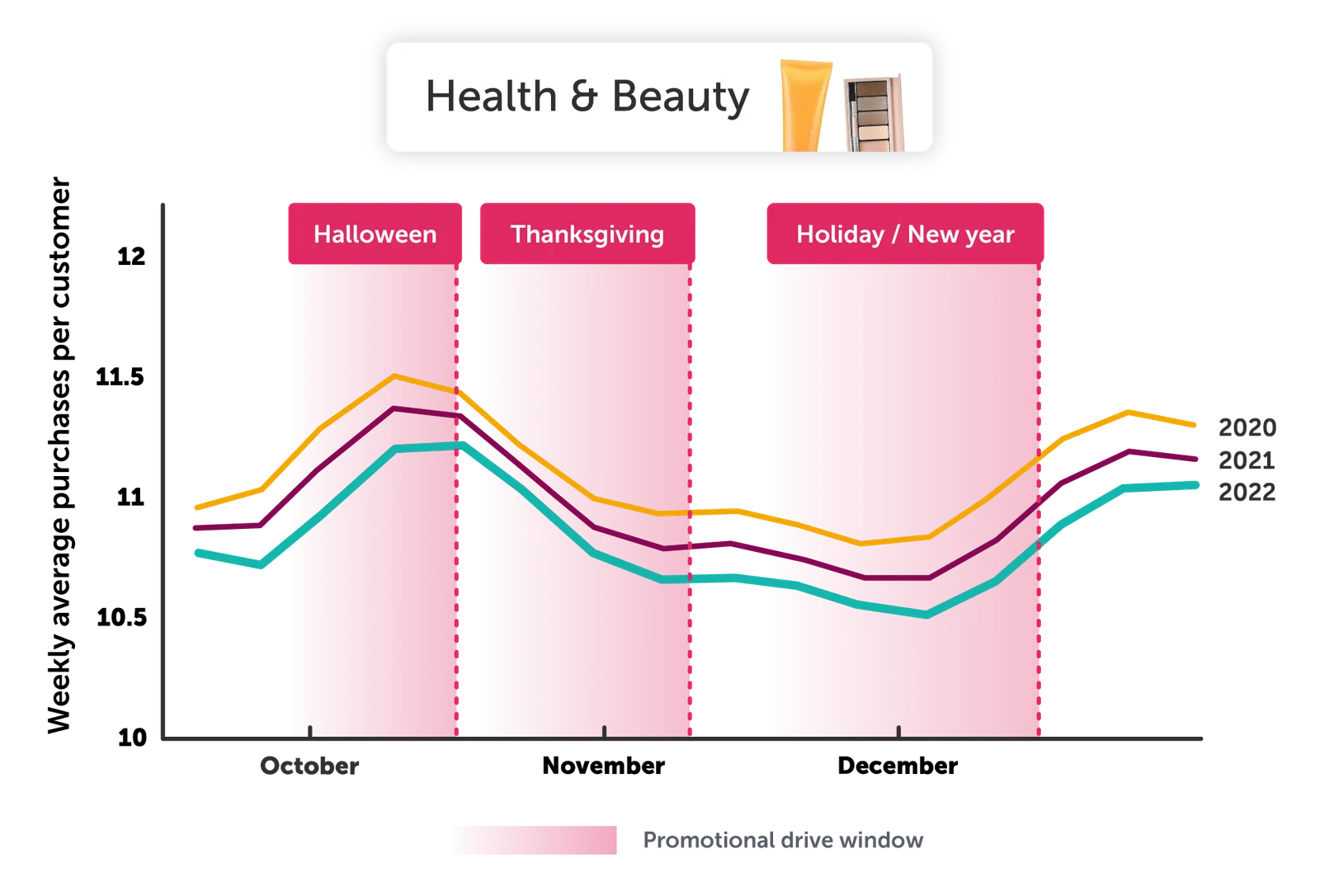

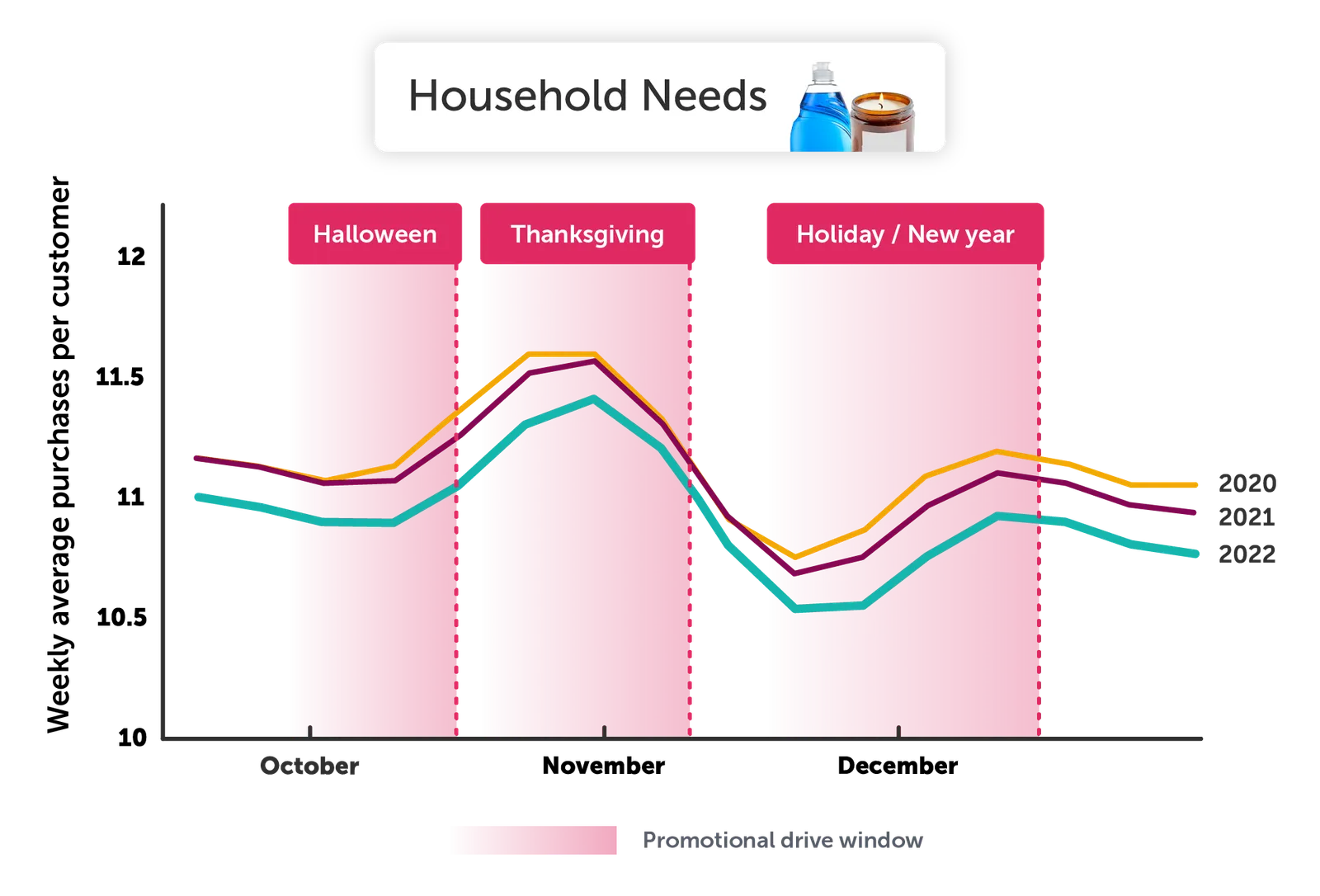

Holiday seasonality trends by category

Notably, across each category in the graphs below, you'll observe the 'Thanksgiving surge' as well as the 'Holiday break lull.'

Brands are well advised to activate ahead of these Q4 spikes and invest in consideration-driving initiatives such as coordinated promotional campaigns to remain top of mind throughout the successive months.

Use the graphs below to identify categories that surge in purchase volume during Holiday months and run pay-per-sale offers to combat price sensitivities and shoppers trading down, protecting market share.

Brands, retailers, and advertisers who join the IPN gain access to deep insights and proprietary data to identify new opportunities for effective promotional strategies — inquire here to learn more.